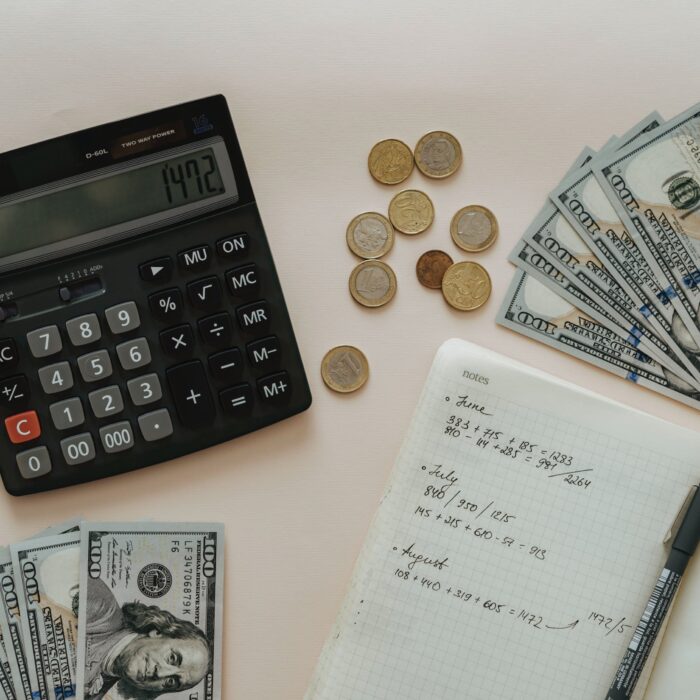

Do You Have to Pay Taxes on Onlyfans Earnings?

If you make money from OnlyFans, you must pay taxes in the United States. Any money earned from subscriptions, PPVs, tips and donations, or anything else must be added to determine the tax amount you owe. You may be able to make some deductions for items or services you paid for to run your account.

As Onlyfans creators often have multiple revenue streams, tax returns are often more complicated than other professions.

This information is relevant for OnlyFans influencers operating in the United States in 2023, covering the tax year of 2023.

Key Takeaways:

- You must file a tax return annually and include your Onlyfans earnings as part of your overall income.

- You must keep track of your Onlyfans expenses to deduct them from your taxes.

- You may be eligible for certain deductions to help lower your tax bill. For example, if you have expenses, such as promoting your account or buying props and outfits.

- It is always a good idea to consult with a tax professional if you have any questions or concerns about your taxes.

How to Pay Your OnlyFans Taxes

One of the easiest and most efficient ways to pay your OnlyFans taxes is with a service app such as Keeper Tax. This program will assist you in inputting the information from your 1099. It will also directly scan your bank and credit card statements for deductibles throughout the year to ensure that every possible write-off is counted.

Keeper Tax works so well that their average user will save $6,076 annually. You can also connect the app to your financial accounts to receive notifications about possible deductions. When tax season comes around, you can easily file directly from the app. Not only is the app extremely useful to the busy influencer, but you can try out their service with their 14-day free trial to see the benefits yourself.

Hobby vs Career Taxes

The IRS provides a list of qualifications to help you determine whether or not your influencing is a career or a hobby. These are as follows:

-

Financial Intent

If you actively work to make your OnlyFans account profitable, treat it as a business.

-

Record Tracking

If you track your income and expenses and treat your OnlyFans account like a business, you likely see it more as a business than a hobby.

-

Financial Dependence

It would be classified as a business if you need the money you earn through your OnlyFans account.

-

Financial Loss

If you have some financial loss due to your influence, even if it is out of your control, the IRS will typically see it as a business.

-

Account Improvement

If you are actively improving how you run your account to earn more from it, you are handling things as a business.

The IRS will also look at the following conditions:

-

Past Experience

Whether or not you have earned money through other social media ventures in the past.

-

Yearly Income

The amount of profit you make year over year from your account.

-

Future Prospects

They may estimate how much you will earn in the future if you continue being an influencer.

If the above metrics leaned more toward either business or hobby, you should better understand where you land on the spectrum, which will help you know what taxes to pay.

Taxes for OnlyFans Hobbyists

The IRS suspended the ability to itemize expenses for hobby-related activities in 2018. As a hobbyist, you will not be allowed any deductions. That being said, there is no self-employment tax for income made on hobbies, meaning you will only have to pay income tax.

If you OnlyFans as a hobby, any income made is taxable. You must file it on the taxable earnings section of form 1040 (on line 21 labeled “other taxable earnings.”) Any brand you work with should send you a 1099 if you earned more than $600.

Federal Taxes for OnlyFans Careerists

If you are a career influencer, you will be responsible for paying self-employment and income taxes. This year, self-employment tax is set at 15.3%. The IRS considers that income goes through the “business” the influencer works for (even though the influencer technically works for themselves).

As a “business,” you must pay Social security and Medicare taxes for both the employer and the employee. This year, your social security is 6.2% for both the employer and the employee, and Medicare is 1.45% each. Add these together, and you will have 12.4% for social security and 2.9% for Medicare tax. The good news is that your self–employment tax is based on net earnings (revenues – relevant expenses), so you may not have to pay as much tax as you think.

In addition to social security and Medicare, you will need to pay income tax. You must pay this on any income you made during the year (minus any applicable expenses or deductions).

Unlike self-employment tax, your income tax will vary depending on the amount of money you make. You can determine the amount of tax you pay off a table (one is included in this article below).

Make Tax Time a Little Easier

The average person finds taxes daunting even if they aren’t running a business. Make things a bit easier for yourself by using accounting software created for start-ups, home businesses, and people working to create a career online.

FreshBooks is a program that helps you keep track of your income and expenses regarding your influencer finances. It offers the bells and whistles you need to run the financial side of things, including invoice options.

Keeping track of your expenses throughout the year will make things easier regarding tax time. You won’t have to search for things you did several months ago because you’ve kept up with the work. Your itemized deductions will help you get tax breaks, whether you do your taxes on your own or hire a professional accountant to do it for you.

FreshBooks also has a 30-day free trial to try out how simple it is for you.

How Does Federal Tax for Influencers Work?

You need to understand two things about your federal taxes: your deductions should come out first, and your tax will be added in a “stairstep” method.

The first thing you need to do is add up all your business expenses so that you can deduct them from your total earnings. The remaining amount will be your taxable earnings. You will show this on your tax forms by filling out the Schedule SE using Schedule C.

Once you have your taxable earnings, you will consult this year’s tax table to see how much you owe. Based on the table below, this will be done in a “stairstep” method. For instance, if you earned $100,000, you won’t need to pay 24% of your entire income (if you’re filing as a single). Here’s how it works: the first $9,875 you earned will be taxed at 10%, the profits between $9875 and $40125 are taxed at 12%, etc. The only income that will be taxed at 24% is what you were paid over $85,526.

The income tax brackets will change yearly, so you should not rely on this year’s table in the future. This is the IRS table to use in the year 2023 to file your 2022 taxes:

2023 Federal Income Tax Table

Tax amounts will fluctuate depending on how much you earn and how you file your taxes. Check out the following page on NerdWallet to learn more.

State Taxes for OnlyFans Influencers

While every state will have a different income tax table, most will be processed similarly. You may be able to deduct your state taxes from your federal income tax if you itemize your deductions.

OnlyFans Expenses You Can Deduct

Deductions will be based on the IRS’s idea of eligible purchases and services. Here are a few things you may be able to deduct if you are a career-orientated influencer:

Employment and Income Taxes

You will need to pay your employment and income taxes quarterly. The IRS will charge interest and fees if you do not pay on time, so it is better to plan ahead, especially since you will get any excess returned when you file your tax return.

You will need to make quarterly payments on a 1040-es, though you will still file your taxes on April 15. You don’t have to pay estimated taxes if you pay less than $1,000 in federal taxes annually.